Forms

-

Claim for Intercounty Transfer of Base Year Value to Replacement Property From Principal Residence Damaged or Destroyed in a Governor-Declared Disaster

BOE-65-PTUse this form if both the sale of the original primary residence and the purchase or new construction of the replacement primary residence occurred before April 1, 2021. For base year value transfers under Proposition 19, please use Claim for Transfer of Base Year Value to Replacement Primary Residence for Victims of Wildfire or Other Natural Disaster (BOE‐19‐V).

-

Claim for Intracounty Transfer of Base Year Value to Replacement Property for Property Damaged or Destroyed in a Governor-Declared Disaster

BOE-65-PUse this form if both the sale of the original primary residence and the purchase or new construction of the replacement primary residence occurred before April 1, 2021. For base year value transfers under Proposition 19, please use Claim for Transfer of Base Year Value to Replacement Primary Residence for Victims of Wildfire or Other Natural Disaster (BOE‐19‐V).

-

Claim for New Construction Exclusion from Supplemental Assessment

PT-64The purpose of the Claim for New Construction Exclusion from Supplemental Assessment form is to allow the property owner to commence construction, while currently offering, or intending to offer, the property for sale or other change in ownership and does not intend to rent, lease, occupy, or otherwise use the property, except as model homes or other use as incidental or an offer for a change...

-

Claim for Reassessment Exclusion for Transfer Between Grandparent and Grandchild Occurring on or After February 16, 2021

BOE‐19‐GThe transfer of a principal residence between grandparent and grandchild may be excluded from reassessment if the fair market value of the family home on the date of transfer is less than the sum of the factored base year value plus $1 million.

-

Claim for Reassessment Exclusion for Transfer Between Parent and Child

BOE-58-AHWhen the ownership is transferred between parent(s) and child(ren), the property is re-assessable to market value, unless the transfer qualifies for the parent/child reassessment exclusion.

This exclusion only applies to transfers that occur on or after November 6, 1986 through February 15, 2021.

-

Claim for Reassessment Exclusion for Transfer Between Parent and Child Occurring on or After February 16, 2021

BOE‐19‐PThe transfer of a principal residence between parent and child may be excluded from reassessment if the fair market value of the family home on the date of transfer is less than the sum of the factored base year value plus $1 million.

-

Claim for Reassessment Exclusion for Transfer From Grandparent to Grandchild

BOE-58-GWhen the ownership is transfer from grandparent(s) to grandchild(ren), the property is re-assessable to market value unless the transfer qualifies for the grandparent(s) to grandchild(ren) reassessment exclusion. The parents of the grandchild(ren) who qualify as child(ren) of the grandparent(s) must be deceased as of the date of the transfer.

-

Claim for Seismic Safety Construction Exclusion from Assessment

BOE-64Section 74.5 of the Revenue and Taxation Code excludes from assessment that portion of an existing structure that consists of the construction and reconstruction of seismic components.

-

Claim for Transfer of Base Year Value to Replacement Primary Residence for Persons at Least Age 55 Years

BOE‐19‐BPlease use this form for base year transfers occurring on or after April 1, 2021.

-

Claim for Transfer of Base Year Value to Replacement Primary Residence for Severely Disabled Persons

BOE‐19‐DPlease use this form for base year transfers occurring on or after April 1, 2021.

-

Claim for Transfer of Base Year Value to Replacement Primary Residence for Victims of Wildfire or Other Natural Disaster

BOE‐19‐VPlease use this form for base year transfers occurring on or after April 1, 2021.

-

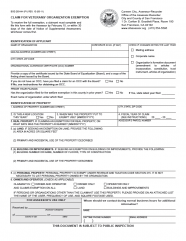

Claim for Veterans' Organization Exemption

BOE-269-AHMust be owned by a veterans’ organization and used/operated exclusively for charitable purposes. Organizational Clearance Certificate is required by the State Board of Equalization.

-

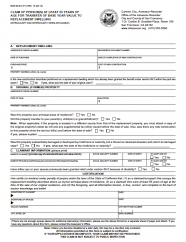

Claim of Person(s) at Least 55 Years of Age for Transfer of Base-Year Value to Replacement Dwelling

BOE-60-AHUse this form if both the sale of the original primary residence and the purchase or new construction of the replacement primary residence occurred before April 1, 2021. For transfers under Proposition 19 please use Claim for Transfer of Base Year Value to Replacement Primary Residence for Persons at Least Age 55 Years (BOE‐19‐B).

-

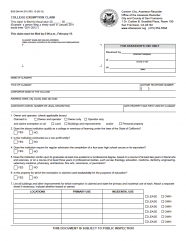

College Exemption Claim

BOE-264-AHThe college exemption is available for buildings, land, equipment and securities, whether owned or leased which are used exclusively for educational purposes by a non-profit educational institution of collegiate grade.

-

Commercial Fishing Boat Exemption

576-EDocumented vessels used primarily for commercial fishing operations or oceanographic studies should use this form to file with the Assessor.

Revenue and Taxation Code section 227 states: "A documented vessel, as defined in Section 130, shall be assessed at 4 percent of its full cash value only if the vessel is engaged or employed exclusively in any of the following: