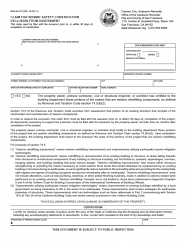

Claim for Seismic Safety Construction Exclusion from Assessment

Section 74.5 of the Revenue and Taxation Code excludes from assessment that portion of an existing structure that consists of the construction and reconstruction of seismic components.

In order to receive the exclusion, this claim form must be filed with the Assessor prior to, or within 30 days of, completion of the project. All documents necessary to support the exclusion must be filed with the Assessor by the property owner no later than six months after completion of the project.

The property owner, primary contractor, civil or structural engineer, or architect shall certify to the Department of Building Inspection , those portions of the project that are seismic retrofitting components, as defined by Revenue and Taxation Code section 74.5(b)(2). Upon completion of the project, the Department of Building Inspection shall report to the Assessor the costs of the portions of the project that are seismic retrofitting components.

Submission Deadline: Within 30 days of completion of the project.

Last updated: 1/03/17