Forms

-

Request for Copies of Business Property Documents

Documents are confidential therefore a written request on a company’s letterhead with an authorized signature must be submitted to Assessor-Recorder, Business Personal Property. Requested documents will be mailed to the address we have on file or may be picked up in person by the account owner with proper ID or the owner’s agent with ID and an authorized letter from the owner.

-

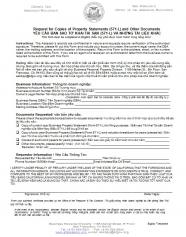

Request for Copies of Business Property Documents ( Vietnamese - YÊU CẦU BẢN SAO TỜ KHAI TÀI SẢN (571-L) VÀ NHỮNG TÀI LIỆU KHÁC)

Documents are confidential therefore a written request on a company’s letterhead with an authorized signature must be submitted to Assessor-Recorder, Business Personal Property. Requested documents will be mailed to the address we have on file or may be picked up in person by the account owner with proper ID or the owner’s agent with ID and an authorized letter from the owner.

-

Request for Copies of Business Property Documents (Chinese - 商業財產申報表 (571-L) 及其他文件副本申請表)

Documents are confidential therefore a written request on a company’s letterhead with an authorized signature must be submitted to Assessor-Recorder, Business Personal Property. Requested documents will be mailed to the address we have on file or may be picked up in person by the account owner with proper ID or the owner’s agent with ID and an authorized letter from the owner.

-

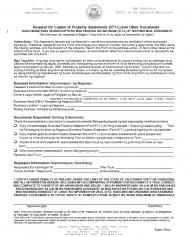

Request for Copies of Business Property Documents (Spanish -- SOLICITUD DE COPIAS DE DECLARACIONES DE BIENES (571-L) Y OTROS DOCUMENTOS)

Documents are confidential therefore a written request on a company’s letterhead with an authorized signature must be submitted to Assessor-Recorder, Business Personal Property. Requested documents will be mailed to the address we have on file or may be picked up in person by the account owner with proper ID or the owner’s agent with ID and an authorized letter from the owner.

-

Request for Copies of Business Property Documents (Tagalog - KAHILINGAN PARA SA MGA KOPYA NG MGA PAHAYAG NG ARI-ARIAN (571-L) AT IBA PANG MGA DOKUMENTO)

Documents are confidential therefore a written request on a company’s letterhead with an authorized signature must be submitted to Assessor-Recorder, Business Personal Property. Requested documents will be mailed to the address we have on file or may be picked up in person by the account owner with proper ID or the owner’s agent with ID and an authorized letter from the owner.

-

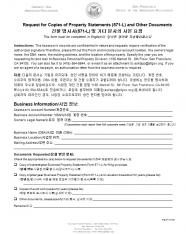

Request for Copies of Business Property Documents (건물 명시서(571-L) 및 기타 문서의 사본 요청)

Documents are confidential therefore a written request on a company’s letterhead with an authorized signature must be submitted to Assessor-Recorder, Business Personal Property. Requested documents will be mailed to the address we have on file or may be picked up in person by the account owner with proper ID or the owner’s agent with ID and an authorized letter from the owner.

-

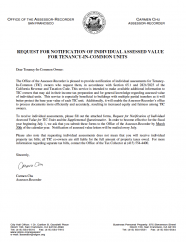

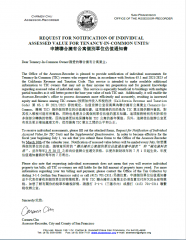

Request Form for Notification of Individual Assessed Value for TIC Units

A TIC is created when a group of individuals purchase a building with the intent that each individual will occupy and own a designated portion of the building. At its core, a TIC is a shared ownership of a single property among two or more people.

-

Request Form for Notification of Individual Assessed Value for TIC Units ( Spanish - solicitud de notificación de valor de tasación individual para unidades en tenencia en común)

A TIC is created when a group of individuals purchase a building with the intent that each individual will occupy and own a designated portion of the building. At its core, a TIC is a shared ownership of a single property among two or more people.

-

Request Form for Notification of Individual Assessed Value for TIC Units ( Tagalog - Kahilingan Para Sa Pagbibigay-Alam Ng Indibiduwal Na Tinasang Halaga Para Sa Mga Tenancy-In-Common Na Mga Unit)

A TIC is created when a group of individuals purchase a building with the intent that each individual will occupy and own a designated portion of the building. At its core, a TIC is a shared ownership of a single property among two or more people.

-

Request Form for Notification of Individual Assessed Value for TIC Units (Chinese - 申請聯合擁有公寓個別單位估值通知書)

A TIC is created when a group of individuals purchase a building with the intent that each individual will occupy and own a designated portion of the building. At its core, a TIC is a shared ownership of a single property among two or more people.

-

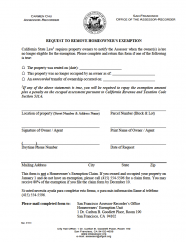

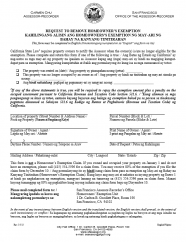

Request to Remove Homeowners’ Exemption

If the property is receiving the Homeowners’ Exemption, but the property owner has moved, it is the property owner’s responsibility to notify the Assessor to remove the exemption.

-

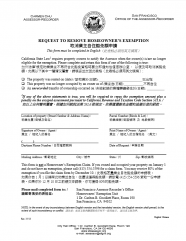

Request to Remove Homeowner’s Exemption (Chinese Version -取消業主自住豁免額申請表)

If the property is receiving the Homeowners’ Exemption, but the property owner has moved, it is the property owner’s responsibility to notify the Assessor to remove the exemption.

-

Request to Remove Homeowner’s Exemption (Russian Version - ОТКАЗ ОТ НАЛОГОВОЙ ЛЬГОТЫ ДЛЯ ДОМОВЛАДЕЛЬЦЕВ)

If the property is receiving the Homeowners’ Exemption, but the property owner has moved, it is the property owner’s responsibility to notify the Assessor to remove the exemption.

-

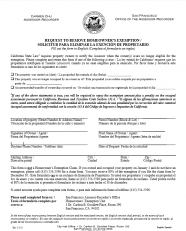

Request to Remove Homeowner’s Exemption (Spanish Version - Solicitud para eliminar la exención de propietario)

If the property is receiving the Homeowners’ Exemption, but the property owner has moved, it is the property owner’s responsibility to notify the Assessor to remove the exemption.

-

Request to Remove Homeowner’s Exemption (Tagalog Version - Kahilingang Alisin Ang Homeowners’s Exemption Ng May-ari Ng Bahay Na Kanyang Tinitirahan)

If the property is receiving the Homeowners’ Exemption, but the property owner has moved, it is the property owner’s responsibility to notify the Assessor to remove the exemption.