Forms

-

Claim for Reassessment Exclusion for Transfer Between Parent and Child

BOE-58-AHWhen the ownership is transferred between parent(s) and child(ren), the property is re-assessable to market value, unless the transfer qualifies for the parent/child reassessment exclusion.

This exclusion only applies to transfers that occur on or after November 6, 1986 through February 15, 2021.

-

Claim for Reassessment Exclusion for Transfer Between Parent and Child Occurring on or After February 16, 2021

BOE‐19‐PThe transfer of a principal residence between parent and child may be excluded from reassessment if the fair market value of the family home on the date of transfer is less than the sum of the factored base year value plus $1 million.

-

Claim for Reassessment Exclusion for Transfer From Grandparent to Grandchild

BOE-58-GWhen the ownership is transfer from grandparent(s) to grandchild(ren), the property is re-assessable to market value unless the transfer qualifies for the grandparent(s) to grandchild(ren) reassessment exclusion. The parents of the grandchild(ren) who qualify as child(ren) of the grandparent(s) must be deceased as of the date of the transfer.

-

Claim for Seismic Safety Construction Exclusion from Assessment

BOE-64Section 74.5 of the Revenue and Taxation Code excludes from assessment that portion of an existing structure that consists of the construction and reconstruction of seismic components.

-

Claim for Transfer of Base Year Value to Replacement Primary Residence for Persons at Least Age 55 Years

BOE‐19‐BPlease use this form for base year transfers occurring on or after April 1, 2021.

-

Claim for Transfer of Base Year Value to Replacement Primary Residence for Severely Disabled Persons

BOE‐19‐DPlease use this form for base year transfers occurring on or after April 1, 2021.

-

Claim for Transfer of Base Year Value to Replacement Primary Residence for Victims of Wildfire or Other Natural Disaster

BOE‐19‐VPlease use this form for base year transfers occurring on or after April 1, 2021.

-

Claim for Veterans' Organization Exemption

BOE-269-AHMust be owned by a veterans’ organization and used/operated exclusively for charitable purposes. Organizational Clearance Certificate is required by the State Board of Equalization.

-

Claim of Person(s) at Least 55 Years of Age for Transfer of Base-Year Value to Replacement Dwelling

BOE-60-AHUse this form if both the sale of the original primary residence and the purchase or new construction of the replacement primary residence occurred before April 1, 2021. For transfers under Proposition 19 please use Claim for Transfer of Base Year Value to Replacement Primary Residence for Persons at Least Age 55 Years (BOE‐19‐B).

-

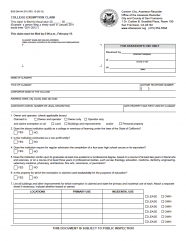

College Exemption Claim

BOE-264-AHThe college exemption is available for buildings, land, equipment and securities, whether owned or leased which are used exclusively for educational purposes by a non-profit educational institution of collegiate grade.

-

Commercial Fishing Boat Exemption

576-EDocumented vessels used primarily for commercial fishing operations or oceanographic studies should use this form to file with the Assessor.

Revenue and Taxation Code section 227 states: "A documented vessel, as defined in Section 130, shall be assessed at 4 percent of its full cash value only if the vessel is engaged or employed exclusively in any of the following:

-

Community Resource Guide (Chinese - 資源指南)

當您繼續與親朋好友重新聯繫時候,估值官辦公室致力於繼續幫助三藩市居民保持健康和繁榮。因此估值官辦公室製作了這份指南和大家分享一些非常重要的社區資源和消息。

-

Community Resource Guide (English)

The Office of the Assessor-Recorder is committed to help San Franciscans achieve health and well-being as you continue to reconnect with your loved ones, neighbors, and our great city. That's why this resource guide was created to share community resources and information important to you.

-

Community Resource Guide (Spanish - guía de recursos)

La Oficina del Asesor-Registrador está comprometida a ayudar a los residentes de San Francisco a lograr la salud y el bienestar a medida que continúa reconectándose con sus seres queridos, vecinos y nuestra gran ciudad. Es por eso que esta guía de recursos se creó para compartir recursos de la comunidad e información importante para usted.