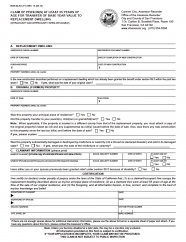

Claim of Person(s) at Least 55 Years of Age for Transfer of Base-Year Value to Replacement Dwelling

Use this form if both the sale of the original primary residence and the purchase or new construction of the replacement primary residence occurred before April 1, 2021. For transfers under Proposition 19 please use Claim for Transfer of Base Year Value to Replacement Primary Residence for Persons at Least Age 55 Years (BOE‐19‐B).

After the property owner has sold the original principal residence and purchased a replacement property, file the claim form with the Assessor’s office to have the original principal residence base year value transferred to the newly purchased residence.

Submission Deadline: Within three years of the date the replacement dwelling was purchased or the new construction of the replacement dwelling was completed. However, if a claim is filed after the three‐year period, relief will be granted beginning with the calendar year in which the claim was filed.

NOTE: In November 2020, California voters passed Proposition 19, which makes changes to property tax benefits for seniors (effective April 1, 2021). Please visit the Proposition 19 resource page for more information.

Last updated: 4/23/21