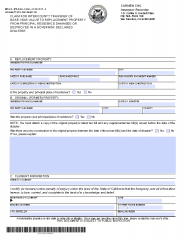

Claim for Intercounty Transfer of Base Year Value to Replacement Property From Principal Residence Damaged or Destroyed in a Governor-Declared Disaster

Use this form if both the sale of the original primary residence and the purchase or new construction of the replacement primary residence occurred before April 1, 2021. For base year value transfers under Proposition 19, please use Claim for Transfer of Base Year Value to Replacement Primary Residence for Victims of Wildfire or Other Natural Disaster (BOE‐19‐V).

California law allows any individual or individuals who reside in an original property (i.e., principal place of residence) to transfer the base year value of the original property that has been substantially damaged of destroyed by a disaster to a replacement property (i.e., principal place of residence) of equal or lesser value in another county that has adopted an ordinance allowing such transfers. The following requirements must be met:

- The disaster must be a major misfortune or calamity in an area subsequently proclaimed by the Governor to be in a state of disaster as a result of the misfortune or calamity;

- The replacement property must have been acquired or newly constructed within three years after the date of the disaster(including land);

- A claim for relief must be filed within three years after the replacement property is acquired or newly constructed.

Property is substantially damaged if the land or the improvements sustain physical damage amounting to more than 50 percent of its full cash value immediately prior to the disaster.

In general, “equal or lesser value” means the fair market value of a replacement property on the date of purchase or completion of construction does not exceed:

- 105 percent of full cash value or fair market value of the original property immediately prior to the date of disaster if a replacement property is purchased or newly constructed within the first year following the date of the damage or destruction of the original property;

- 110 percent of full cash value or fair market value of the original property immediately prior to the date of disaster if are placement property is purchased or newly constructed within the second year following the date of the damage or destruction of the original property; or

- 115 percent of full cash value or fair market value of the original property immediately prior to the date of disaster if a replacement property is purchased or newly constructed within the third year following the date of the damage or destruction of the original property.

The acquisition of an ownership interest in a legal entity that, directly or indirectly, owns real property is not an acquisition of replacement property under the law.

Submission Deadline: Claim must be filed within three years after the replacement property is acquired or newly constructed.

NOTE: In November 2020, California voters passed Proposition 19, which makes changes to property tax benefits. Please visit the Proposition 19 resource page for more information.

Last updated: 8/24/21