Forms

-

Data Request Form – Unsecured & Secured Roll Data

You can request data either by downloading this form and mailing it in, or emailing our office.

-

Disabled Persons Claim for Exclusion of New Construction and Certificate of Disability

BOE-63Only construction completed on or after June 6, 1990 is eligible. The exclusion does not apply to accessibility improvements and features that are usual or customary for comparable properties not occupied by disabled persons.

-

Disabled Persons Claim for Transfer of Base-Year Value to Replacement Dwelling

BOE-62Use this form if both the sale of the original primary residence and the purchase or new construction of the replacement primary residence occurred before April 1, 2021. For base year value transfers under Proposition 19, please use Claim for Transfer of Base Year Value to Replacement Primary Residence for Severely Disabled Persons (BOE‐19‐D).

-

Disabled Veterans' Tax Exemption Change of Eligibility Report

BOE-261GNTThis form allows for a property exemption for the home of a veteran, or the home of the unmarried surviving spouse of a veteran, who has incurred an injury or disease during military service, is blind in both eyes, has lost the use of two or more limbs, or is totally disabled.

-

Disaster Relief Application

Typical misfortunes or calamities which may qualify for reduced assessment include fire, flood, or earthquake damage. Damage to personal property, such as household furnishings, is not eligible since it is not assessed for property tax purposes.

-

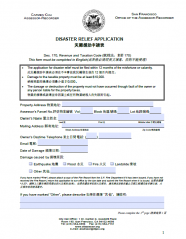

Disaster Relief Application ( Chinese - 災難援助申請表)

Typical misfortunes or calamities which may qualify for reduced assessment include fire, flood, or earthquake damage. Damage to personal property, such as household furnishings, is not eligible since it is not assessed for property tax purposes.

-

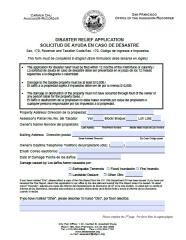

Disaster Relief Application (Spanish - Solicitud de ayuda en caso de desastre)

Typical misfortunes or calamities which may qualify for reduced assessment include fire, flood, or earthquake damage. Damage to personal property, such as household furnishings, is not eligible since it is not assessed for property tax purposes.

-

Disaster Relief Application (Tagalog - Aplikasyon Para Sa Tulong Sa Kalamidad)

Typical misfortunes or calamities which may qualify for reduced assessment include fire, flood, or earthquake damage. Damage to personal property, such as household furnishings, is not eligible since it is not assessed for property tax purposes.