About Proposition 19 (2020)

In November 2020, California voters passed Proposition 19 , which makes changes to property tax benefits for families, seniors, severely disabled persons, and victims of natural disaster in our state. In response, our Office has consolidated resources, including video tutorials, frequently asked questions, forms and reference links, on this page (see separate tabs) to help you understand and prepare for the upcoming changes.

We are also organizing a series of Digital Family Wealth Forums, online events designed to provide families with the necessary tools to understand this new law and continue their financial planning. Recording of our first webinar is available below. Visit here to register for future events.

What is Proposition 19?

On November 3, 2020, California voters approved Proposition 19, the Home Protection for Seniors, Severely Disabled, Families and Victims of Wildfire or Natural Disasters Act. Proposition 19 is constitutional amendment that limits people who inherit family properties from keeping the low property tax base unless they use the home as their primary residence, but it also allows homeowners who are over 55 years of age, disabled, or victims of a wildfire or natural disaster to transfer their assessed value of their primary home to a newly purchased or newly constructed replacement primary residence up to three times.

The new law will make important changes to two existing statewide property tax saving programs:

- Replace Proposition 58(1986) and Proposition 193(1996) by limiting parent-and-child transfer and grandparent-to-grandchild transfer exclusions (see current Prop. 58/193 here) - Effective 2/16/2021

- Replace Proposition 60 (1986) and Proposition 90 (1988) programs for home transfer by seniors and Proposition 110 (1990) program for severely disabled persons - Effective 4/1/2021

(For more information on changes to programs for victims of wildfires and other natural disasters, please consult the State Board of Equalization’s website)

Changes to Parent-and-Child and Grandparent-to-Grandchild Transfer Exclusions (Effective February 16, 2021)

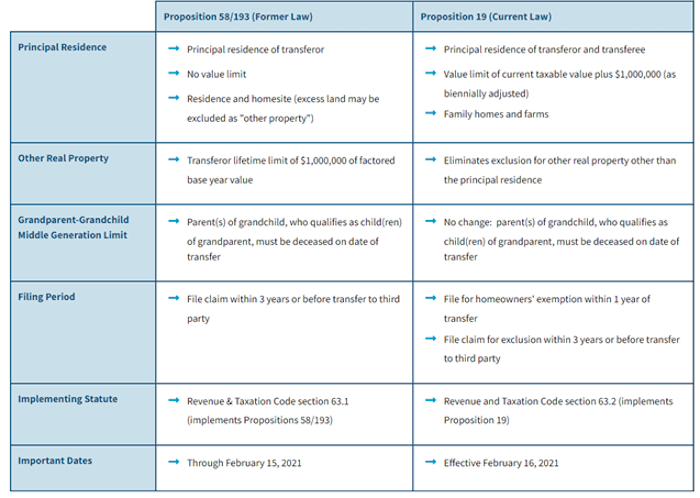

Current laws allow parents, grandparents and children to pass on the existing assessed values of their primary residence and other properties up to $1 million in assessed values without reassessment. However, under Proposition 19 these programs will be limited with fewer tax savings opportunities. See below for the chart developed by the State Board of Equalization to compare the current law and the effects of Proposition 19.

PARENT-CHILD & GRANDPARENT-GRANDCHILD EXCLUSION

Changes to Senior Replacement Home Transfers (Effective Apri1 1, 2021)

(Video tutorial recorded by Assessor-Recorder Torres in January 2021)

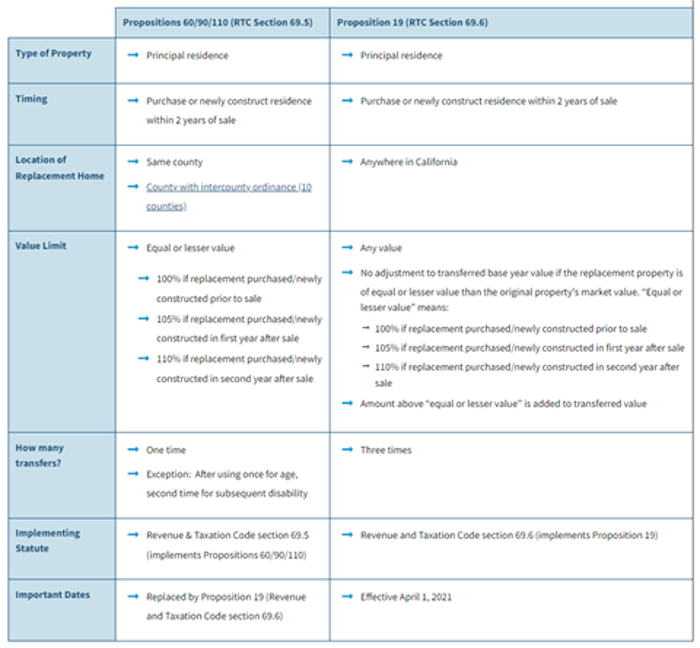

Current laws allow seniors over 55 years old and severly disabled persons to transfer the taxable value of their existing home to their new replacement home, so long as the market value of the new home is equal to or less than the existing home's value. The program was also limited to once in a lifetime, with additional restrictions where the replacement home is located (usually within the same county or within some counties that allow for reciprocity). Proposition 19 will make these programs more flexible. See below for the chart developed by the State Board of Equalization to compare the current law and the effects of Proposition 19.

BASE YEAR VALUE TRANSFER – PERSONS AT LEAST AGE 55/DISABLED

On June 6, 1978, California voters approved Proposition 13, an amendment to the California’s Constitution that rolled back most local real property assessments to 1975 market value levels and limited the property tax rate to 1 percent plus the rate necessary to fund local voter-approved bonded indebtedness.

In short, the assessment year 1975-76 serves as the original base year value for real property assessments. Proposition 13 also limits annual increases in the base year value of real property to no more than 2 percent, except when property changes ownership or undergoes new construction. In that case, the base year is the year in which the real property (or portion thereof) is purchased, changes owners, or is newly constructed. Read more about Proposition 13 here.

First of all, before making any decisions, please talk to your family members and seek professional advice to understand the consequences and tax implications of transferring property ownership. Although we would like to give you as much information as possible, under California law, we are PROHIBITED from providing legal advice or assisting in document preparation.

However, for general information on recording title deed to Add Name/Delete Name/Change Vesting, the following documents are required at recording:

- Some type of deed (Grant, Quit Claim, etc.) or other document transferring ownership: Our office cannot advise you as to which type of document you should use. Please be sure that the Assessors Parcel Number (APN), also known as Assessor Block and Lot Numbers, AND street address of property are specifically listed on the FIRST page of the document. The documents needed to transfer the land or real property (affidavit, deed, declaration, order etc.) may be obtained through a title company, a real estate attorney, stationery stores, or various websites, such as the Sacramento County Public Law Library.

- Preliminary Change of Ownership Report (PCOR) form

- Transfer Tax Affidavit

- Assuming that a property is transferred before February 16, 2021, the provisions of the old law still apply, including filing a claim with the Assessor within specified time limits. The claim forms for Prop 58 and Prop 193 are available under the tab "Forms/Attachments".

Please visit the webpages on title deed and recording requirements for more information.

If the transfer is a gift, then there generally is no transfer tax. On the Preliminary Change of Ownership form, be sure to mark the gift box in part 2. In addition, on the Transfer Tax Affidavit, mark the Gift box in question #8 and completely fill out and sign the Transfer Tax Affidavit form.

If there is consideration paid, the transfer tax basis generally is the consideration paid by the buyer.

Please note that the Assessor-Recorder may transmit deeds and tax affidavits for all claimed gift exemptions to the Internal Revenue Service. Our staff may not give you financial or legal advice. Questions regarding gift tax should be directed to the Internal Revenue Service or your financial advisor.

Although we would like to give you as much information as possible, under California law, we are PROHIBITED from providing legal advice or assisting in document preparation. (Section 6125 of the Business and Professions Code). Questions regarding gift tax, capital gains, methods of holding title, and other financial advice should be directed to your financial advisor and the Internal Revenue Service.

Documents may be submitted to our office in one of three ways:

By drop box: The Assessor-Recorder drop box is located outside City Hall at 1 Dr. Carlton B. Goodlett Place (the box is in the window at the Grove Street entrance) for all day (24 hours) document drop off. The drop box is checked daily and documents are taken directly back to Assessor-Recorder staff to process Monday - Friday 8AM - 2PM (last pickup). Please ensure that your documents are securely packaged with payment. Payment for recording fees and transfer taxes (if applicable) may be made by checks (with preprinted name and address), or money order payable to SF Assessor-Recorder.

By mail: To our City Hall location (1 Dr. Carlton B. Goodlett Place, Room 190, San Francisco, 94102). Payment for recording fees and transfer taxes (if applicable) may be made by cash, checks (with preprinted name and address), or money order payable to SF Assessor-Recorder.

Electronically: Electronic Recording (e-recording) is the process of recording documents via a secure internet portal that would otherwise be sent by mail or courier to the San Francisco County Assessor-Recorder’s Office. E-recording is an efficient and secure means to submit documents to our office for recordation electronically. Once recorded, documents are returned to the submitter the same day, usually in less than an hour, and payment of recording fees and taxes are made the following day via ACH wire transfer. E-recording was previously limited to title companies, title insurers, financial institutions, and government entities. However, the regulations governing e-recording were recently updated in response to AB2143 (2016), which opens up e-recording to entities that can demonstrate at least $1 million in general liability insurance. These new regulations went into effect on January 1, 2020.

Learn more by visiting our recording page here. (Please note: procedures may differ from county to county. Check with the county in which your property is located to confirm details for recording documents)

Depend on the number of pages of the deed. Generally, for pages measure 8.5”x11”, it costs $14 for the first page and $3 for any additional page within the same document. However, if the grantee (also known as transferee, buyer, receiver) will not be occupying the property on deed, an additional $75 fee will charged due to the passage of SB2(Atkins) at the California Legislature in 2017. Vist here to learn more on recording fees.

If you are unsure of the number of pages within the document, you may write on your check, below the amount line, “NTE” for “Not To Exceed” and indicate a dollar amount. The Recorder staff will write in the exact amount in the dollar amount line and complete the second line on your check to indicate the exact amount to be charged to your bank account.

Please contact your trust attorney to understand your terms as every family’s dynamic is different and every trust is different. The date you transfer the property to your children determines whether the transfer will be treated according to the old law or the new law (effective on February 16, 2021). Generally, a transfer of property into your own revocable living trust is not a transfer to your children under the old law.

Transfer on Death Deed allows you to avoid probate by indicating who you would like to inherit your property after death. However, it does not protect you from changes in property tax laws. Since the date of transfer will be the date of death, that date will determine if the transfer will be treated according to the old law or the new law (effective on February 16, 2021).

The child receiving the property would need to move into the unit that was previously the parent’s principal residence to take advantage of the parent-child exclusion from reassessment under Proposition 19. The rest of the property would be reassessed to 100% of fair market value. This process would not create multiple tax bills. The amounts would be added together to create 1 tax bill with the new amount going forward.