Notices

-

Prop 19: Transfers in Family (Chinese -19號提案: 家庭成員間業權轉讓)

加州的業主如果在父母、子女或祖父 母之間進行業權轉讓,可能有資格豁免樓價重估至市場價值. 請參閱以下了解更多詳情。

19號提案需知:

(錄影自2021年1月5日本辦公室舉行有關加州19號提案的網上家庭理財日講座, 粵語翻譯)

(KTSF 26台溫馨傳萬家有關19號提案訪問及詳情,2020年12月)

本辦公室提供給星島日報有關19號提案的專欄内容:

資訊一覽表:

https://www.sfassessor.org/sites/default/files/documents/ARS_Factsheet_Prop58_193_Chinese_0.pdf

視頻:

https://www.sfassessor.org/news-information/videos/property-tax-savings-families-chinese

物業轉讓須知:

https://www.sfassessor.org/sites/default/files/documents/ARS_factsheet_PropertyTransfer_Chinese.pdf

業主自住豁免額:

-

Prop 19: Transfers in Family (Filipino - Proposition 19: Mga Paglipat Sa Pamilya

ALAM MO BA NA ANG may ari ng mga ari-arian sa California ay maaring iwasan ang bagong tasa para sa pangkaraniwang halaga kung ang ari-arian ay ililipat galing sa magulang, anak ,o lolo o lola? Maari lang tingnan sa ibaba ang karagdagang impormasyon.

Fact Sheet:

https://www.sfassessor.org/sites/default/files/documents/ARS_Factsheet_Prop58_193_Filipino_0.pdf

Mga Bagay Na Dapat Malaman Sa Paglipat Ng Ari-Arian:

https://www.sfassessor.org/sites/default/files/documents/ARS_factsheet_PropertyTransfer_Filipino.pdf

Pagkalibre ng May-ari ng Bahay:

-

Property Tax Savings For Homeowners

This fact sheet includes helpful information for homeowners centered on services our office provides. In addition, it includes helpful hints and tips around applying for your homeowner's exemption and a number of other property tax programs.

-

Property Tax Savings: Transfers In Family

This fact sheet includes helpful information for family members who are interested in transfering property to one another. It has helpful tips about (1) Parent-to-Child transfers and (2) Grandparent-to-Grandchild transfers. Review the eligibility check lists to see if you qualify.

NOTE: In November 2020, California voters passed Proposition 19, which makes changes to property tax benefits for families (effective February 16, 2021). Please visit the Proposition 19 resource page for more information.

-

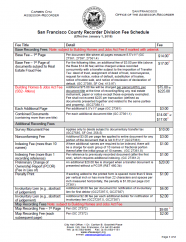

Recording Fee Schedule

San Francisco County Recorder Division Fee Schedule(Effective January 1, 2021) -

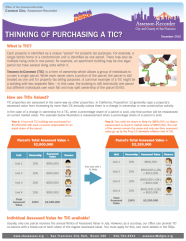

Request For Notification of Individual Assessed Value For Tenancy-In-Common Units

The notification of individual assessments for Tenancy-In-Common (TIC) owners who request them is a courtesy notice provided by the Office of the Assessor-Recorder. The purpose of the notice is to make available additional information to TIC owners that may aid in their income tax preperation and for general knowledge regarding assessed value. In order to become effective for the fiscal year beginning July 1, we ask that these forms be submitted to the Office of the Assessor-Recorder by March 30th of the calendar year.

-

Short Term Rental -- FAQ

-

Standard Data Record (SDR) Notice to File

-

Things To Know During Property Transfer

This fact sheet includes helpful information for homeowners that are interested in transfering their property. It has information about commonly recorded documents, how to search our office for records, and helpful hints around transfer trax.

-

Thinking of Purchasing a TIC?

This fact sheet includes helpful information for homebuyers who are interested in purchasing Tenancy-In-Common (TIC) properties. It includes helpful information on valuation of TIC properties, as well as similarities and difference between TICs and condominiums.

- « first

- ‹ previous

- 1

- 2

- 3