Forms

-

441(d) Cost Report Excel Sheet

441(d) Cost Report Excel Sheet is available for download here.

-

Address Change Form

It is the owner’s responsibility to report a change of mailing address. Please click on the Download form below to print out a change of mailing address application.

-

Affidavit of Cotenant Residency

BOE-58-HThe change in ownership exclusion for a transfer of an interest in real property between cotenants that takes effect upon the death of one cotenant applies as long as all of the following are met:

-

Agent Authorization Form

This form certifies that the signatory owns, possesses, controls, or manages the property referenced in the authorization and that they have the authority to designate an agent to act on behalf of all the owners of identified property.

-

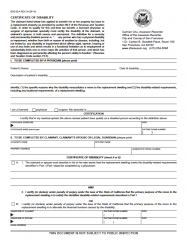

Certificate of Disability

BOE-62-AIf submitting in connection to a base year value transfer claim, use this form if the sale of the original primary residence and the purchase or new construction of the replacement primary residence occurred before April 1, 2021. For base year value transfers under Proposition 19, please use Certificate of Disability – for transfers completed on or after 4/1/2021 (BOE‐19‐DC).

-

Certificate of Disability – for transfers completed on or after 4/1/2021

BOE‐19‐DCPlease use this form for base year transfers occurring on or after April 1, 2021.

-

Change in Ownership Statement

BOE-502-AHIf the Preliminary Change in Ownership Report was not filed at the time of recording, the Assessor-Recorder’s Office will mail a request for the Change in Ownership Statement to be completed.

-

Change in Ownership Statement, Death of Real Property Owner

BOE-502-DSubmit the completed form to the San Francisco Assessor-Recorder’s Office. An incomplete form will be denied.

-

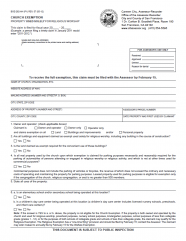

Church Exemption Claim

BOE-262-AHChurch exemption claims must be filed with the Assessor annually on or before February 15 to receive the full exemption.

-

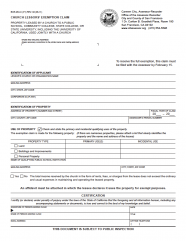

Church Lessors' Exemption Claim

BOE-263-CChurches leasing a portion of its property to a Public School, Community College, State College, or State University, including the University of California, may be exempt from real and business property taxes.

-

City and County of San Francisco Approved E-Recording Agents

City and County of San Francisco Approved E-Recording Agents List.

-

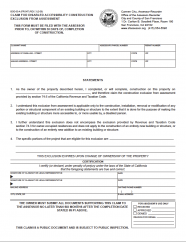

Claim for Disabled Accessibility Construction Exclusion from Assessment

BOE-63-AThis exclusion applies to any construction, installation, removal, or modification completed on or after June 7, 1994. Bear in mind that there are deadlines for when the exclusion form needs to be submitted.

-

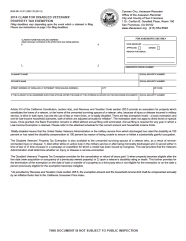

Claim for Disabled Veterans Property Tax Exemption

BOE-261-GVeterans with 100% disability, or partially disabled and unemployable, or their unmarried surviving spouses, are eligible for up to a $161,083 exemption. If total household income does not exceed $72,335, the 100% disabled veteran may qualify for up to a $241,627 exemption.

Qualifying income levels are subject to change.