Forms

-

Notice of Assessed Value Sample (English)

The Notice of Assessed Value (NAV) is sent to the taxpayer of record by the county assessor annually to notify taxpayers of the assessed value. The NAV is typically mailed in July of each calendar year. The assessed values represent market value as of the January 1 lien date. This notice is not a tax bill and does not require payment.

-

Notice of Recission of Claim to Transfer Base Year Value to Replacement Dwelling

BOE-60-NRNOTE: In November 2020, California voters passed Proposition 19, which makes changes to property tax benefits. Please visit the Proposition 19 resource page for more information.

This form applies only to claims filed for base year value transfers under Proposition 60/90/110.

-

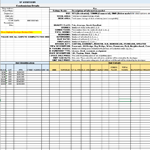

Parcel Management Condominium Descriptions and Values Template

The Parcel Management Condominium Descriptions and Values template is available for download here. Please e-mail the completed form to assessor.mapping@sfgov.org

-

Possessory Interest Mailing Address Change Form

It is the owner’s responsibility to report a change of mailing address. Please click on the Download Form button below to print out a Possessory Interest Change of Mailing Address application.