Forms

-

Index To Records

The Index To Records is made available to assist the public with access to City records. This is in accordance with the Sunshine Ordinance. A member of the public may request any of the records listed on the Index To Records in accordance with applicable public records laws.

-

Initial Purchaser Claim for Solar Energy System New Construction

BOE-64-SESIn order to qualify for this reduction, this claim form must be completed and signed by the buyer and filed with the Assessor. Please refer to the General Information section for details.

-

Leased Equipment Detail Report

The Leased Equipment Detail Report is one of two (2) templates provided by the Business Property Division of the Office of the Assessor-Recorder to assist lessors report equipment out on lease in the City and County of San Francisco.

-

Lessee’ Exemption Claim B

BOE-263-BLeased property used exclusively by and for Public Schools, Community Colleges, State Colleges, State Universities, or University of California.

-

Lessors' Exemption Claim

BOE-263Exempts property owners from real property or personal property taxes who leases to Churches, Public Schools, Community and State Colleges, State Universities, Nonprofit Colleges, Free Public Libraries and Free Museums and provides compensation to them in the form of rental reduction or refund.

-

Lower Exemption, Family Household Income Reporting Worksheet

BOE-267-LAWorksheet provided to each household living on property. To accompany claim seeking exemption for low-income housing that is owned and operated by a nonprofit organization.

-

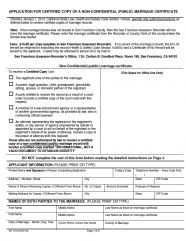

Marriage Certificate Request

The Office of the Assessor-Recorder maintains all public marriage licenses issued in the City and County of San Francisco.

-

Marriage Certificate Request (Chinese Version -索取公開結婚證書認證副本申請表)

Many governmental agencies as well as employers require proof of marriage, which is the certified copy of a marriage certificate. Effective January 1, 2010, California State Law, Health & Safety Code Section 103526 permits only authorized persons to obtain a certified copy (see application for defined list).

-

Marriage Certificate Request (Spanish Version - Solicitud para copia certificada de acta de matrimonio no confidencial)

Many governmental agencies as well as employers require proof of marriage, which is the certified copy of a marriage certificate. Effective January 1, 2010, California State Law, Health & Safety Code Section 103526 permits only authorized persons to obtain a certified copy (see application for defined list).

-

Marriage Certificate Request (Tagalog Version - Aplikasyon Para Sa Sertipikadong Kopya Ng Hindi Kompidensiyal Pampubliko Na Sertipiko Ng Kasal)

Many governmental agencies as well as employers require proof of marriage, which is the certified copy of a marriage certificate. Effective January 1, 2010, California State Law, Health & Safety Code Section 103526 permits only authorized persons to obtain a certified copy (see application for defined list).