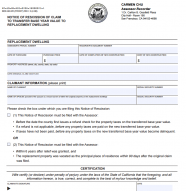

Notice of Recission of Claim to Transfer Base Year Value to Replacement Dwelling

NOTE: In November 2020, California voters passed Proposition 19, which makes changes to property tax benefits. Please visit the Proposition 19 resource page for more information.

This form applies only to claims filed for base year value transfers under Proposition 60/90/110.

A claimant may rescind their previously filed claim for a base year value transfer (prop 60/90). A claim may be rescinded according to Revenue and Taxation Code section 69.5(i) if this notice of rescission, signed by the original claimant(s), is delivered to the Assessor’s office (where the claim was filed) before any of the following have occurred:

- Before the date the county first issues a refund check for the property taxes on the transferred base year value. If a refund is not applicable, before any property taxes are paid on the new transferred base year value. If taxes have not been paid, before any property taxes on the new transferred base year value become delinquent. OR

- Within 6 years after relief was granted, and the replacement property was vacated as the principal place of residence within 90 days after the original claim was filed

Note: In November 2020, California voters passed Proposition 19, which makes changes to property tax benefits. Please visit the Proposition 19 resource page for more information.

Last updated: 4/19/21