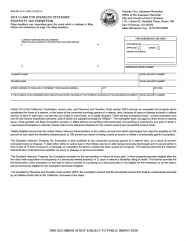

Claim for Disabled Veterans Property Tax Exemption

Veterans with 100% disability, or partially disabled and unemployable, or their unmarried surviving spouses, are eligible for up to a $161,083 exemption. If total household income does not exceed $72,335, the 100% disabled veteran may qualify for up to a $241,627 exemption.

Qualifying income levels are subject to change.

Form Number:

BOE-261-G

Last updated: 1/30/23