Forms

-

Restrictive Covenant Modification Form

Recordation of this document allows owners to strike out blatant racial, religious, or otherwise unlawfully restrictive covenants from a previously recorded document after the City Attorney's Office determines such language violates the fair housing laws and is void.

-

Restrictive Covenant Modification Program Implementation Plan

Pursuant to the 2021 legislation set forth in Assembly Bill AB-1466 and the California Government Code Section 12956.3, the San Francisco Assessor-Recorder’s Office (ASR) has developed a plan to identity documents in its Official Record containing unlawful covenants in violation of GC Section 12955(l) and to rerecord them with the restrictive language redacted through its Restrictive Covenant...

-

RP Taxpayer Help Pages

This user guide provides detailed instructions on how to navigate our Community Portal from submitting customer service requests to filing exemption forms and/or responding to information requests.

-

SB2 Exemption Recording Coversheet

The California Legislature passed SB2 (Atkins) on September 29, 2017, stipulating that effective January 1, 2018, certain recordable documents will be charged an additional fee to support the Building Homes & Jobs Act.

-

Seismic/Solar Transfer Tax Exemption (Prop N)

A partial exemption shall only apply to the initial transfer by the person who installed the active solar system or made the seismic safety improvements. The amount of this partial exemption shall not exceed the transferor’s cost of seismic retrofitting improvements or the active solar system. Multi-family residential properties are eligible for this partial exemption.

-

Summary Leased Equipment Schedule

The Summary Leased Equipment Schedule is one of two (2) templates provided by the Business Property Division of the Office of the Assessor-Recorder to assist lessors report equipment out on lease in the City and County of San Francisco.

-

Supplemental Affidavit for BOE-236, Housing – Lower-Income Households

BOE-236-ASection 236 of the California Revenue and Taxation Code provides that property used exclusively for providing housing for lower-income households can qualify for an exemption from property taxes.

-

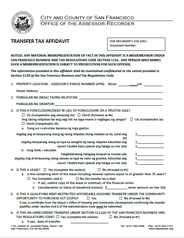

Transfer Tax Affidavit

The purpose of this form is to explain the nature of the transaction and to determine if the transfer is taxable.

-

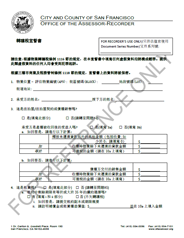

Transfer Tax Affidavit (Chinese - 轉讓稅宣誓書) (For Reference Only)

The purpose of this form is to explain the nature of the transaction and to determine if the transfer is taxable. The Chinese version is for reference only. Please submit your transfer tax affidavit in English.

-

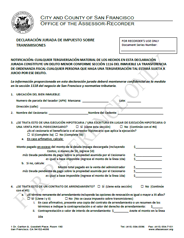

Transfer Tax Affidavit (Spanish - declaración jurada de impuesto sobre transmisiones) (For Reference Only)

The purpose of this form is to explain the nature of the transaction and to determine if the transfer is taxable. The Spanish version is for reference only. Please submit your transfer tax affidavit in English.

-

Transfer Tax Affidavit (Tagalog - salaysay sa buwis sa paglipat ng ari-arian) (For Reference Only)

The purpose of this form is to explain the nature of the transaction and to determine if the transfer is taxable. The Tagalog version is for reference only. Please submit your transfer tax affidavit in English.

-

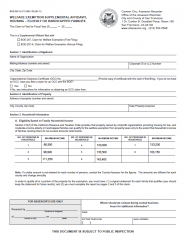

Welfare Exemption Supplemental Affidavit, Housing - Elderly or Handicapped Families

BOE-267-HAn affidavit required when seeking exemption on housing for elderly or handicapped families that is owned and operated by a nonprofit organization.